Economic analyst Victor Bhoroma believes that low confidence in the market has an adverse impact on measures meant to revive the economy.

Bhoroma said:

Zimbabwe’s economy wobbles on the brink of recession; the cost of low confidence in the market is taking a huge toll on various policies to resuscitate the economy. Prices for most consumer food staffs, industrial products and services have been skyrocketing since the October 2018 Monitory Policy Statement with official inflation rate eclipsing 66.8 percent in March 2019.

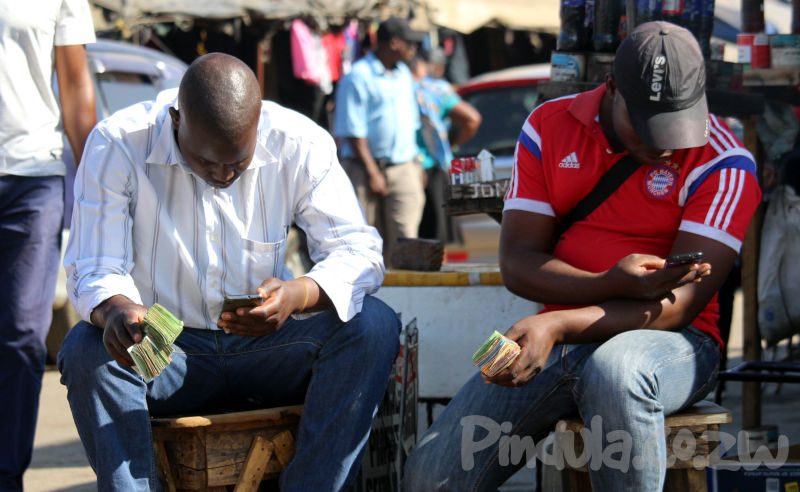

The Reserve Bank Of Zimbabwe revealed in 2018 that funds amounting to US$1 billion, owned by Zimbabweans were being held outside the country. It is believed that the unpredictability of local markets is the major reason why Zimbabweans externalise their investments.

There are fears that there will be further deterioration of confidence in local markets. A recent IMF statement after the completion of the second staff monitoring program read:

Zimbabwe is facing deep macro-economic imbalances, with large fiscal deficits and significant distortions in foreign exchange and other markets, which severely hamper the functioning of the economy.

Efforts by the Finance Minister and RBZ Governor to revive the economy have so far proved to be ineffective. Bhoroma has argued that it would be necessary to take measures to foster confidence through entrenchment of good governance practices.

Confidence is among other variables that have immense influence over markets.

Related:

- WATCH: Biti Expects Armageddon Due To Government’s Incapacity For Genuine Reforms

- Mangudya blames S.A. for economic crisis, says they should have given us loan in 2008 to use the Rand

More: 263Chat

WhatsApp Group:

WhatsApp Group:  Telegram Group:

Telegram Group:

Back to top