The Zimbabwe dollar lost ground against the US dollar on the Reserve Bank of Zimbabwe (RBZ) foreign currency (forex) auction conducted on Tuesday, 31 August 2021.

Last week the weighted average was US$1: ZWL$85.9084 but fell to US$1: ZWL$86.0551 this week.

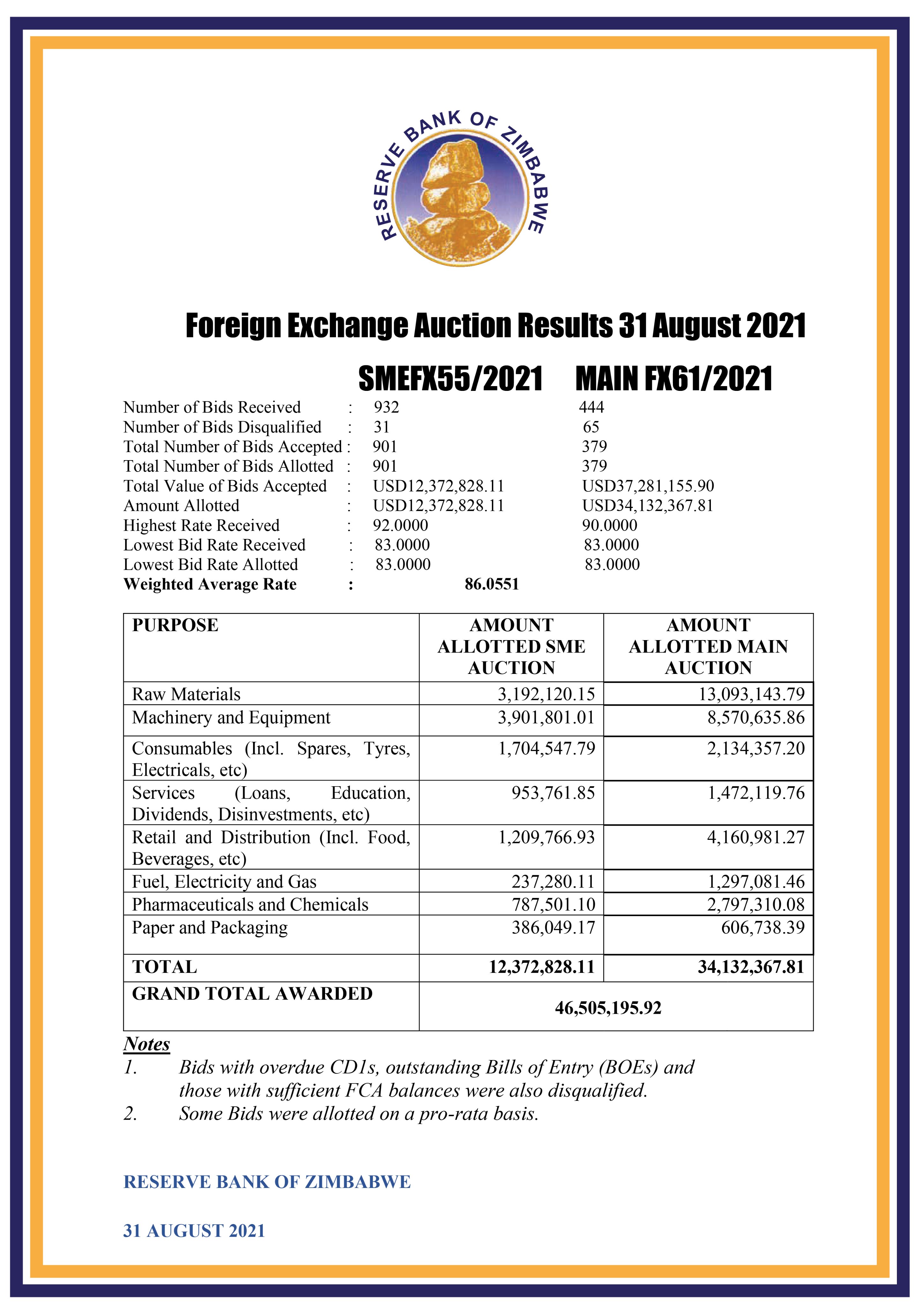

This week, US$12.3 million was allocated to the Small to Medium Enterprises forex auction while US$34.1 million was allocated to the main forex auction.

In total, US$46.5 million was allotted this week, with the bulk of the allotment going to raw materials followed by machinery and equipment.

932 bids were received on the Small to Medium enterprises forex auction, with 901 accepted and 31 disqualified.

On the main forex auction, a total of 444 bids were received, 379 were accepted while 65 were disqualified.

The Reserve Bank of Zimbabwe (RBZ) said bids that were disqualified were not eligible in terms of the Priority List.

Bids with overdue CDIs, outstanding Bills of Entry (BOEs), and those with sufficient FCA balances were also disqualified.

Some bids were allotted on a pro-rata basis to conform with the Import Priority List, the RBZ said.

Below is the RBZ summary of the forex auction:

| Number of Bids Received : | 932 | 444 |

| Number of Bids Disqualified : | 31 | 65 |

| Total Number of Bids Accepted : | 901 | 379 |

| Total Number of Bids Allotted : | 901 | 379 |

| Total Value of Bids Accepted : | USD12,372,828.11 | USD37,281,155.90 |

| Amount Allotted : | USD12,372,828.11 | USD34,132,367.81 |

| Highest Rate Received : | 92.0000 | 90.0000 |

| Lowest Bid Rate Received : | 83.0000 | 83.0000 |

| Lowest Bid Rate Allotted : | 83.0000 | 83.0000 |

| Weighted Average Rate : | 86.0551 |

| PURPOSE | AMOUNT ALLOTTED SME AUCTION | AMOUNT ALLOTTED MAIN AUCTION |

| Raw Materials | 3,192,120.15 | 13,093,143.79 |

| Machinery and Equipment | 3,901,801.01 | 8,570,635.86 |

| Consumables (Incl. Spares, Tyres, Electricals, etc) | 1,704,547.79 | 2,134,357.20 |

| Services (Loans, Education, Dividends, Disinvestments, etc) | 953,761.85 | 1,472,119.76 |

| Retail and Distribution (Incl. Food, Beverages, etc) | 1,209,766.93 | 4,160,981.27 |

| Fuel, Electricity and Gas | 237,280.11 | 1,297,081.46 |

| Pharmaceuticals and Chemicals | 787,501.10 | 2,797,310.08 |

| Paper and Packaging | 386,049.17 | 606,738.39 |

| TOTAL | 12,372,828.11 | 34,132,367.81 |

| GRAND TOTAL AWARDED | 46,505,195.92 |

Every week is exactly the same story. Don’t be hoodwinked – there is no auction taking place. All the same companies put in a bid for x amount of forex at $85:USD$1, then it is ALLOCATED. An auction where you have to wait for 3 -4 months before receiving your ‘bought goods is not an auction. It is a request and settlement.If it was an auction then it would be ZL160 for each USD1 and payable within 3 hours.Its all a fake

I would not pay the ridiculous ZL160 for a mere US dollar? People should learn to value their own currency. What is the benefit of making U$ richer by paying over the odds for the currency? What I can agree with you, is that the delay in the payment of the allocation comes with a risk, only because the value of the dollar changes from hour to hour on he international market. Its value today will not be its value next week.

The delayed price at ‘the auction’ is about .011 cents, but the street rate (that’s the real state of affairs in the country) over 2 months would have gained nearly ZWL$10. So, whose fooling who?