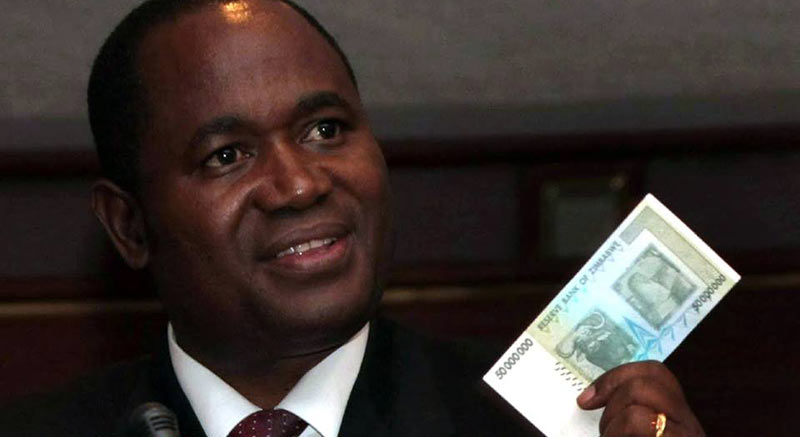

Reserve Bank of Zimbabwe (RBZ) governor John Mangudya said the interbank foreign currency market will not fail like it did during his predecessor Gideon Gono’s tenure.

Gono introduced the interbank foreign currency market in 2008 but launched an investigation into financial institutions that were allegedly abusing the facility with a view to cancelling their operating licences. At the time the central bank was investigating allegations in the market that some managers within the banking community are buying foreign currency in their individual capacities but using their bank’s structures. However Mangudya (JM) told Tinashe Kairiza (TK) that the interbank market will not fail. Below is an excerpt of the interview:

TK: Let us talk about the tenure of your predecessor, former governor Gideon Gono. He also experimented with liberalising the exchange rate and the consequences were quite catastrophic. A decade later, you are doing the same. Should we expect a different outcome?

JM: Let me be very blunt. We can never compare today and 2008. The economic fundamentals are so different. You are saying right now companies are producing and they are exporting. An estimated US$6,2 billion was earned in 2018. If you go back to 2008, there was no forex to talk about. We were buying bread from South Africa. There was nothing. So, yes, RBZ liberalised. What happened in 2008 and now is very different.

More: Independent

Wrong, Mr Magundya. We do not have RTGS dollars in our accounts. Our bank accounts were designated US dollars back in 2009/2010. You are playing with semantics and you hope to hoodwink all of the people all of the time. Never happens! The Government (ZANU PF once again) has robbed Zimbabweans of their genuine money and you have allowed yourself to be party to it. You continue your mantra that the bond note has not failed and yet a simpleton knows it has utterly failed and that you are not a man of your word.

The Government relies on brutality to cower its people into submission. One only has to look at Venezuela -which by comparison makes Zimbabwean economy look good – where every day thousands take to the street to voice their protestation. To date it has made very little difference but they are not running for safety nor fearing to take to streets.

While economic fundamentals are not in place, that is before full economic recovery in Zimbabwe this measure will not take route in Zimbabwe it sooner leads to deeper hardships as speculation on the envisaged market is bound to be rise in a country without a credible industrial base.